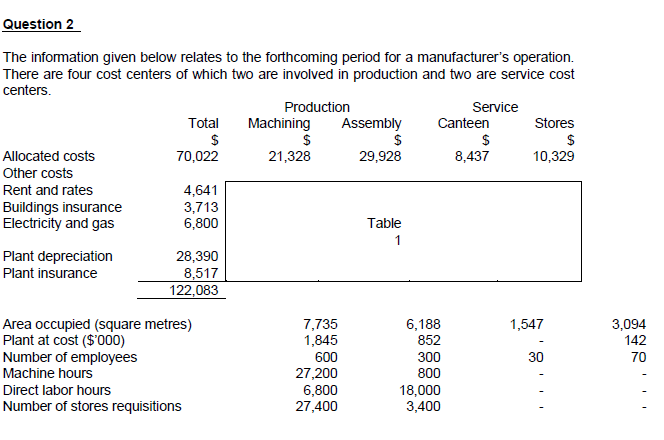

a. Complete the above table 1 by using the most appropriate base.

我的答案:

…………………………………Total………Machining……Assembly……Canteen………Stores

Allocated costs……………70,022………21,328………29,928………8,437…………10,329

Rent and rates…………….4,641………….1934…………1547…………387……………773

Buildings insurance………3,713…………1547…………1238…………309…………….619

Electricity and gas…………6,800…………2833…………2267…………567……………1133

———————————

Plant depreciation……….28,390……….18,450…………8,520……….—……………1,420

Plant insurance…………….8,517……….5535………….2,556…………—…………….426

……………………………

……………………….Total…….122,083……51,627………46,056………9,700………14,700

Apportion Canteen……………………………6000…………3000……….(9,700)…………700

Apportion Stores…………………………….13700…………1700………—…………….(15400)

———————————-

……………………….Total………………………71,327………50,756

對嗎?

(b). Use this information to calculate a production overhead absorption rate for Machining

department and for Assembly department based on machine hours and labor hours

respectively. Round off to nearest dollars for the above table.

如何計算production overhead absorption rate?

是否Production overhead absorption rate for Machining department:

71,327/27,200 = $2.62/machine hour

Production overhead absorption rate for Assembly department:

50,756/18,000= $2.82/direct labour hour